Chart Patterns - Reversal Patterns

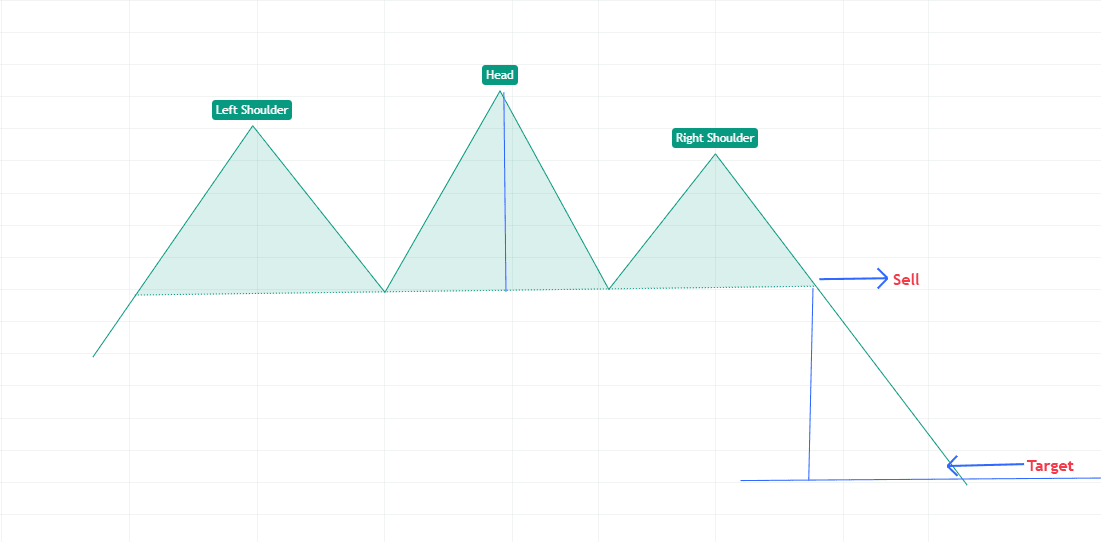

Head and Shoulders Pattern

The Head and Shoulders pattern is a prominent reversal pattern in technical analysis, typically signaling the end of an uptrend and the beginning of a downtrend. This pattern is widely recognized among traders for its reliability in forecasting price movements. In this comprehensive guide, we will explore how to identify, trade, and manage the Head and Shoulders pattern effectively.

1. Identifying the Pattern

Structure:

The Head and Shoulders pattern consists of three peaks:

- Left Shoulder: The price rises to a peak and then declines.

- Head: The price rises to a higher peak, which is the highest point of the pattern, before declining again.

- Right Shoulder: The price rises to a peak that is lower than the head but similar in height to the left shoulder, then declines again.

Neckline:

The neckline is formed by connecting the lows of the declines following the left shoulder and the head. This line acts as a support level, and a breakout below the neckline confirms the reversal.

2. Detailed Pattern Identification

Formation Criteria:

To accurately identify the Head and Shoulders pattern, look for the following characteristics:

- The formation should clearly show three peaks: left shoulder, head, and right shoulder.

- The head should be the highest point, while the left and right shoulders should be of similar height.

Volume Analysis:

Volume plays a crucial role in confirming the validity of the pattern:

- Volume tends to be higher during the formation of the head, indicating strong buying interest.

- Volume usually decreases during the formation of the right shoulder.

- A significant increase in volume upon the price breaking below the neckline serves as strong confirmation of the pattern.

Time Frame:

The Head and Shoulders pattern can appear on various time frames (e.g., hourly, daily, weekly). However, it is generally more reliable when formed on higher time frames, as these patterns reflect more stable market dynamics.

3. Trading the Head and Shoulders

Entry Point:

- Entry After Breakout: The optimal entry point is when the price breaks below the neckline with increased volume. A confirmed breakout is essential; traders should look for a close below the neckline rather than just a brief dip.

Stop Loss:

- Placement: To protect against false breakouts, set your stop loss above the most recent high (the peak of the right shoulder). This placement helps minimize potential losses.

Target Price:

- Measuring the Pattern: Measure the distance from the highest point of the head to the neckline. This distance can be projected downwards from the breakout point (the neckline) to establish a target price.

Example:

If the head forms at $80 and the neckline is at $70, the distance is $10. Therefore, if the price breaks below the neckline at $70, the target would be set at $60 ($70 - $10).

4. Risk Management

Risk-Reward Ratio:

Implementing a robust risk management strategy is crucial for successful trading. Aim for a risk-reward ratio of at least 1:2 or better. For example, if your stop loss is $5 above your entry point, target a price that is at least $10 below your entry.

Position Sizing:

Determine your position size based on your overall trading strategy and risk tolerance. This approach helps manage exposure and ensures that no single trade has a detrimental impact on your capital.

5. Tips for Successful Trading

-

Confirm with Other Indicators: Utilize additional technical indicators such as RSI (Relative Strength Index) or MACD (Moving Average Convergence Divergence) to confirm bearish momentum.

-

Market Context: Always consider the overall market conditions; the Head and Shoulders pattern is more effective in bearish market environments. Analyzing broader market trends can enhance your trade's success rate.

-

Patience: Exercise patience and wait for the price to confirm the breakout below the neckline before entering a trade. Rushing into a trade can lead to unnecessary losses.

6. Example Trade Setup

-

Identify the Pattern: Look for the formation of a Head and Shoulders on a daily chart.

-

Draw the Neckline: Connect the lows of the declines following the left shoulder and head to establish the neckline.

-

Enter Trade: Once the price breaks below the neckline at $70 with strong volume, enter a short position.

-

Set Stop Loss: Place your stop loss at $75, which is above the right shoulder.

-

Determine Target: Measure the distance from the head to the neckline ($10) and subtract this from the breakout point ($70) to set a target at $60.

Conclusion

The Head and Shoulders pattern is a powerful signal for traders looking to capitalize on potential trend reversals. By following a systematic approach to identifying the pattern, managing risk, and confirming with volume and other indicators, you can enhance your trading strategy and increase your chances of success. Always remember to practice sound risk management and adapt your strategy based on prevailing market conditions. Happy trading!

Disclaimer: This article is for educational purposes only and should not be considered financial advice. Read our full disclaimer.