Indicators - Support & Resistance Indicators

Pivot Points

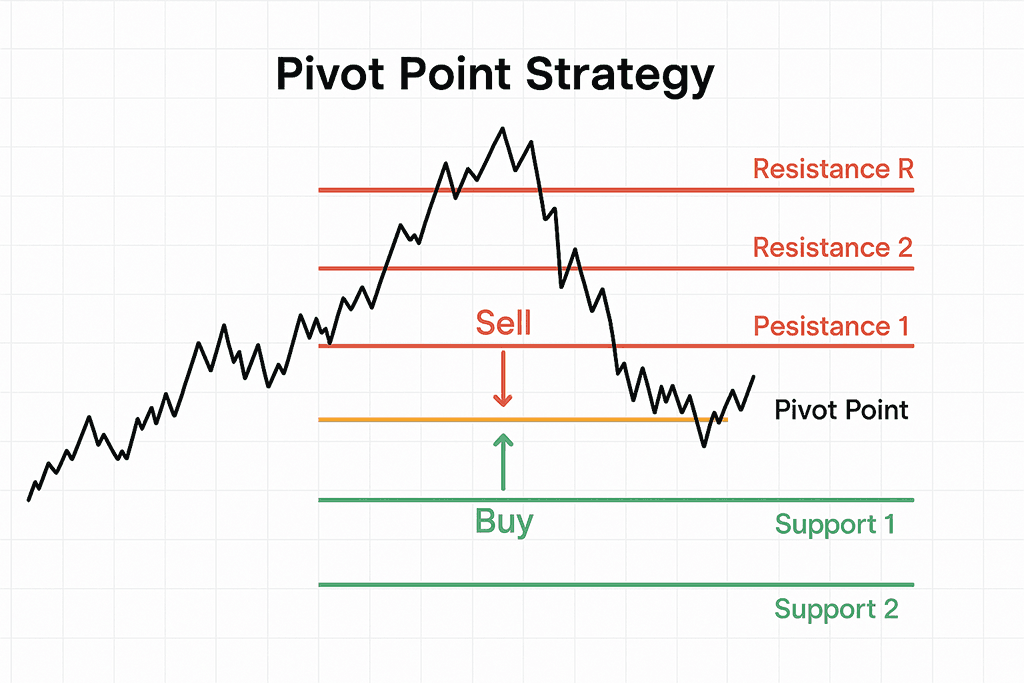

Pivot Points are essential technical indicators used by traders to determine potential support and resistance levels in the market. They serve as critical reference points, helping traders identify possible price reversals or continuations. In this guide, we will explore what pivot points are, how to calculate them, and effective trading strategies to enhance your trading performance.

What are Pivot Points?

Pivot Points are calculated based on the previous period's high, low, and close prices. They consist of a central pivot point and several support and resistance levels. Traders often use these levels to make informed trading decisions, as they indicate where the price is likely to experience significant movement.

Key Components of Pivot Points

-

Pivot Point (PP): The central point calculated using the formula: [ PP = \frac{(High + Low + Close)}{3} ]

-

Support and Resistance Levels:

- First Support (S1): [ S1 = (PP \times 2) - High ]

- First Resistance (R1): [ R1 = (PP \times 2) - Low ]

- Second Support (S2) and Resistance (R2):

[

S2 = PP - (High - Low)

]

[

R2 = PP + (High - Low)

]

How to Calculate Pivot Points

Step-by-Step Calculation

-

Identify Key Prices: Gather the previous period’s high, low, and close prices.

-

Calculate the Pivot Point (PP): Use the formula provided above.

-

Determine Support and Resistance Levels: Calculate S1, R1, S2, and R2 using their respective formulas.

Example Calculation

- Previous Period High: $100

- Previous Period Low: $90

- Previous Period Close: $95

- Calculate PP: [ PP = \frac{(100 + 90 + 95)}{3} = 95 ]

- Calculate S1 and R1: [ S1 = (95 \times 2) - 100 = 90 ] [ R1 = (95 \times 2) - 90 = 100 ]

- Calculate S2 and R2: [ S2 = 95 - (100 - 90) = 85 ] [ R2 = 95 + (100 - 90) = 105 ]

Trading Strategies Using Pivot Points

1. Breakout Trading Strategy

-

Concept: Trade breakouts when the price crosses above resistance or below support levels.

-

Entry Signal:

- Enter a long position when the price breaks above R1.

- Enter a short position when the price breaks below S1.

2. Reversal Trading Strategy

-

Concept: Look for price reversals at pivot point levels.

-

Entry Signal:

- Enter a long position when the price bounces off S1 or S2.

- Enter a short position when the price bounces off R1 or R2.

3. Confirming with Additional Indicators

- Combine with Indicators: Use other technical indicators (like RSI or MACD) to confirm signals from pivot points. This increases the reliability of your trading decisions.

Risk Management with Pivot Points

Setting Stop Loss

- Stop Loss Placement:

- For long positions, set your stop loss below the support level (S1 or S2).

- For short positions, set your stop loss above the resistance level (R1 or R2).

Position Sizing

- Determine Position Size: Use appropriate position sizing based on your overall trading strategy and risk tolerance to manage exposure effectively.

Tips for Successful Trading with Pivot Points

-

Practice Patience: Wait for confirmation signals before entering trades based on pivot points to minimize false signals.

-

Use Multiple Time Frames: Analyze pivot points across different time frames to gain a broader perspective on potential market movements.

-

Monitor Market Conditions: Be aware of the broader market context; major news events can influence price movements and pivot point effectiveness.

-

Adapt to Market Volatility: Adjust your trading strategy based on market volatility; in more volatile markets, consider wider stop-loss levels.

Example Trade Setup

-

Identify Conditions: Observe the price approaching a pivot point level (PP, S1, R1).

-

Entry Signal:

- For a long position, enter when the price bounces off S1 with strong volume.

- For a short position, enter when the price fails to break above R1.

-

Set Stop Loss: Place your stop loss below S1 for longs or above R1 for shorts.

-

Determine Target Price: Set your target based on the next support or resistance level.

Conclusion

Pivot Points are a valuable tool for traders looking to identify key levels of support and resistance in the market. By understanding how to calculate and apply pivot points effectively, you can enhance your trading strategies and improve your overall performance. Always practice sound risk management and adapt your strategies based on market conditions. Happy trading!

Disclaimer: This article is for educational purposes only and should not be considered financial advice. Read our full disclaimer.