Harmonic Patterns - Harmonic Patterns

Deep Crab Pattern

The Deep Crab pattern is a highly accurate and advanced harmonic pattern used in technical analysis. Developed by Scott Carney, the Deep Crab is a variation of the original Crab pattern, designed to detect precise price reversals at extreme Fibonacci levels. Traders favor the Deep Crab pattern for its excellent risk-reward ratio and its ability to pinpoint key turning points in the market.

In this guide, you’ll learn everything about the Deep Crab pattern—its structure, Fibonacci measurements, identification tips, and how to trade it effectively.

What is the Deep Crab Pattern?

The Deep Crab is a five-point harmonic pattern labeled as X-A-B-C-D, where the final D point offers a high-probability reversal zone (PRZ). What makes this pattern unique is the deep retracement at point B and an extended move to point D.

Key Characteristics:

- Deep B retracement (up to 0.886 of XA)

- Extended CD leg reaching 2.24 or 3.618 of the BC leg

- Precise Fibonacci alignment for strong reversal signals

- Suitable for both bullish and bearish market conditions

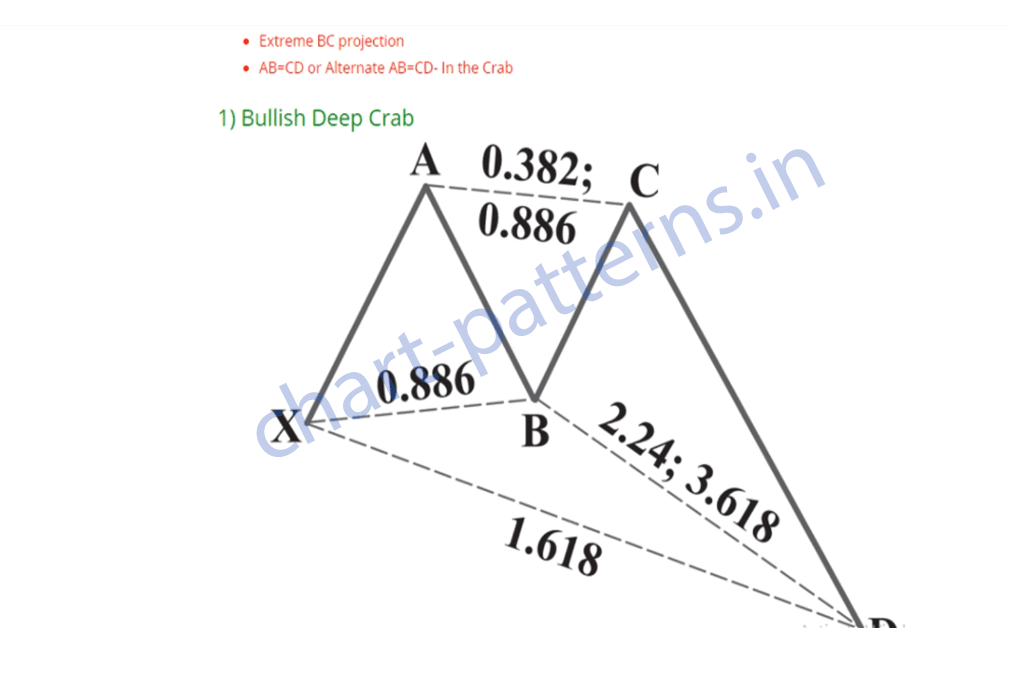

Structure of the Deep Crab Pattern

1. XA Leg:

This is the initial impulse wave.

2. AB Leg:

Retraces between 0.618 and 0.886 of the XA leg, often closer to 0.886 in a Deep Crab pattern.

3. BC Leg:

Retraces between 0.382 and 0.886 of the AB leg.

4. CD Leg:

The final leg extends to 2.24 – 3.618 Fibonacci extension of the BC leg. This extreme extension completes the pattern at point D, which is the potential reversal zone (PRZ).

Fibonacci Ratios for Deep Crab Pattern

- AB = 0.886 retracement of XA

- BC = 0.382 to 0.886 retracement of AB

- CD = 2.24 to 3.618 extension of BC

- AD = 1.618 extension of XA (optional confirmation)

These precise Fibonacci levels form the foundation of the Deep Crab’s reversal potential.

Bullish vs. Bearish Deep Crab

✅ Bullish Deep Crab

- Forms during a downtrend

- Point D marks a potential bullish reversal zone

- Traders enter long trades at point D

❌ Bearish Deep Crab

- Forms during an uptrend

- Point D marks a potential bearish reversal zone

- Traders enter short trades at point D

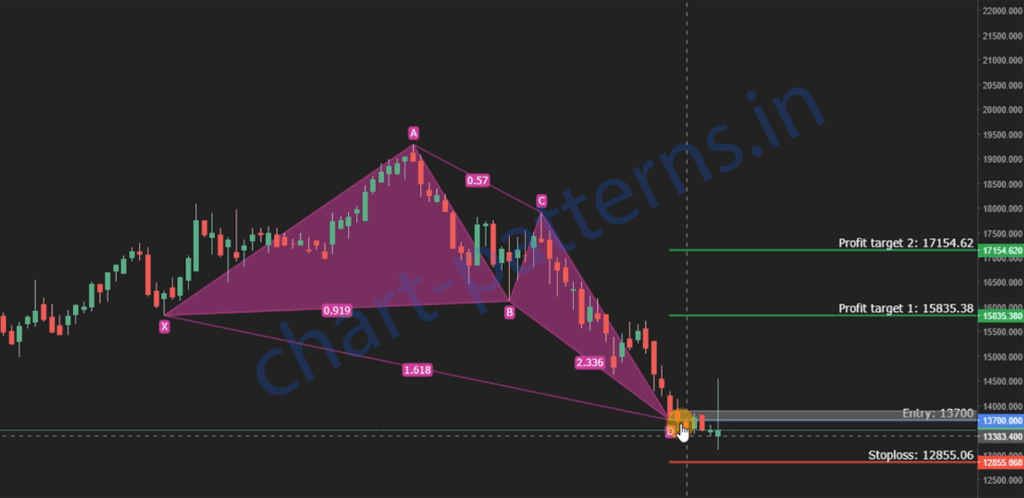

How to Trade the Deep Crab Pattern

📥 Entry Point

- Enter the trade at point D, after the pattern completes and shows reversal confirmation (e.g., candlestick reversal patterns like hammer, engulfing, or doji).

🛑 Stop Loss

- Place your stop loss slightly beyond point D to protect against false breakouts.

🎯 Take Profit

- Target 1: Point B

- Target 2: Point C

- Optionally use Fibonacci retracement levels from CD leg (e.g., 0.618 and 0.382) for profit booking.

Example Trade Setup (Bullish Deep Crab)

- XA: Price rises from $100 to $130

- AB: Retracement to $110 (0.886 of XA)

- BC: Moves to $120 (approx. 0.618 of AB)

- CD: Drops to $95 (2.618 extension of BC)

- Entry: Buy at $95 (Point D)

- Stop Loss: Below $93

- Targets:

- First target at $110 (Point B)

- Second target at $120 (Point C)

Why Use the Deep Crab Pattern?

✔ High Accuracy: Precise Fibonacci-based rules lead to reliable setups

✔ Strong Risk-Reward Ratio: Deep entries provide lower stop levels and higher targets

✔ Early Entry into Reversals: Get in at market turning points with confirmation

✔ Works on All Timeframes: From 5-minute charts to daily and weekly analysis

Pro Tips for Trading the Deep Crab

- 📊 Combine with indicators like RSI divergence, MACD crossover, or Volume spikes to confirm the PRZ.

- 📉 Use trendlines or support/resistance zones to align with the pattern.

- 🔁 Always wait for confirmation at point D—never enter before the pattern completes.

Final Thoughts

The Deep Crab pattern is a powerful and refined harmonic pattern that enables traders to predict reversals with high precision. Though it requires careful measurement and patience, its performance can be outstanding when combined with other technical tools and confirmation strategies.

By mastering the structure and Fibonacci alignments of the Deep Crab, you can elevate your harmonic trading skills and seize high-probability trades at key price levels. Start spotting the Deep Crab on your charts and refine your entries with confidence and discipline.

Happy trading! 📈

Disclaimer: This article is for educational purposes only and should not be considered financial advice. Read our full disclaimer.