Chart Patterns - Reversal Patterns

Double Top

The Double Top pattern is one of the most recognized bearish reversal patterns in technical analysis. It typically signals a potential trend reversal after a strong uptrend, making it a critical tool for traders looking to capitalize on market movements. In this guide, we will explore how to identify, trade, and manage the Double Top pattern effectively.

What is the Double Top Pattern?

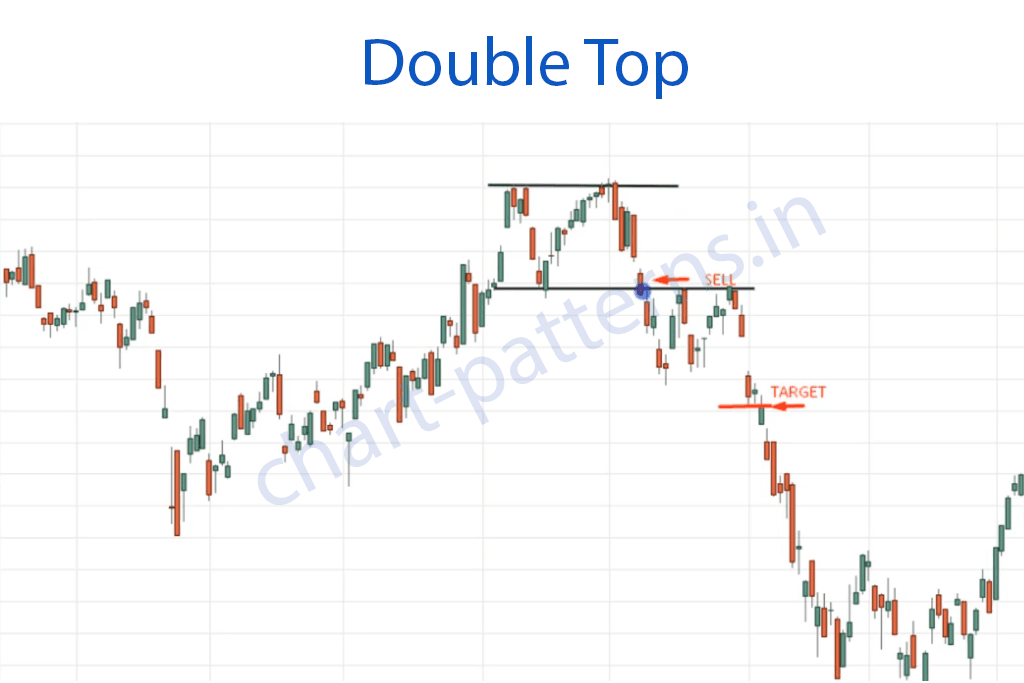

The Double Top pattern is characterized by two peaks at approximately the same price level, indicating that buyers are losing momentum. Understanding this pattern can help traders make informed decisions about entering and exiting trades.

Key Features of the Double Top Pattern

- Formation of Two Peaks: The price rises to a high, forming the first peak, then declines, followed by a second peak that is roughly equal to the first.

- Neckline: This is drawn by connecting the lows of the declines between the peaks. A breakout below this neckline confirms the pattern.

- Trend Context: The Double Top pattern usually forms after a sustained uptrend, highlighting a shift in market sentiment.

How to Identify the Double Top Pattern

Structure of the Double Top

- First Peak: The price reaches a high point, followed by a retracement.

- Second Peak: The price attempts to rise again but fails to surpass the first peak, indicating weakening bullish momentum.

- Neckline: Connect the lows between the peaks to establish the neckline, which acts as a support level.

Volume Analysis

Volume plays a significant role in confirming the Double Top pattern:

- Increased Volume on First Peak: High volume during the formation of the first peak indicates strong buying interest.

- Decreased Volume on Second Peak: A drop in volume during the second peak suggests that buyers are losing strength.

- Volume Spike on Breakout: A significant increase in volume when the price breaks below the neckline reinforces the validity of the pattern.

Time Frame Considerations

The Double Top pattern can be observed on various time frames (e.g., hourly, daily, weekly). However, it is more reliable when formed on higher time frames, as these reflect stronger market dynamics.

Trading the Double Top Pattern

Entry Strategy

- Entry After Breakout: The ideal entry point is when the price closes below the neckline with increased volume. This signals a confirmed reversal.

Setting Stop Loss

- Stop Loss Placement: To mitigate risk, set your stop loss above the most recent high (the peak of the second top). This protects against potential false breakouts.

Determining Target Price

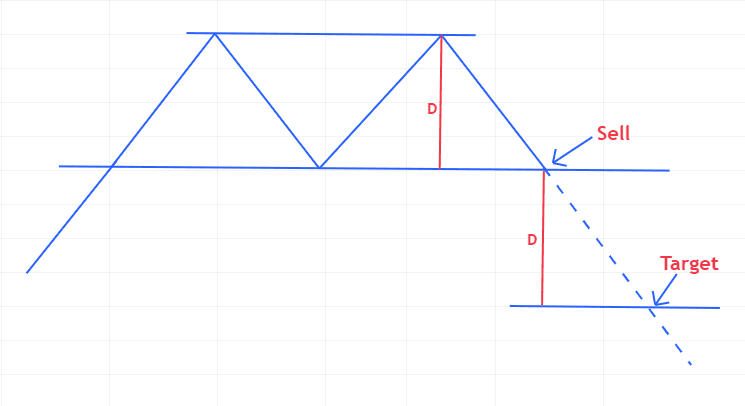

- Target Calculation: Measure the distance between the peaks and the neckline. This distance can be projected downwards from the neckline to establish your target price. see below image for reference.

Example Calculation

If the peaks are at $80 and the neckline at $70, the distance is $10. If the price breaks below the neckline at $70, set your target at $60 ($70 - $10).

Risk Management in Trading

Importance of Risk-Reward Ratio

A solid risk management strategy is crucial for successful trading. Aim for a risk-reward ratio of at least 1:2. For instance, if your stop loss is set at $5 above your entry, target a price that is at least $10 below your entry.

Position Sizing

Determine your position size based on your overall trading strategy and risk tolerance. Proper position sizing helps manage exposure and minimizes the impact of any single trade on your capital.

Tips for Successful Trading

-

Use Additional Indicators: Incorporate other technical indicators, such as RSI (Relative Strength Index) or MACD (Moving Average Convergence Divergence), to confirm bearish momentum.

-

Assess Market Context: Consider overall market conditions; the Double Top pattern is more effective in bearish environments. Understanding broader market trends can enhance your trading success.

-

Be Patient: Wait for confirmation of the breakout below the neckline before entering a trade. Avoid premature entries to minimize losses.

Example Trade Setup

-

Identify the Pattern: Look for the formation of a Double Top on a daily chart.

-

Draw the Neckline: Connect the lows of the declines following the peaks to establish the neckline.

-

Enter the Trade: Once the price breaks below the neckline at $70 with strong volume, enter a short position.

-

Set Stop Loss: Place your stop loss at $75, which is above the second peak.

-

Determine Target Price: Measure the distance from the peaks to the neckline ($10) and subtract this from the breakout point ($70) to set a target at $60.

Conclusion

The Double Top pattern is a powerful bearish signal that can help traders identify potential trend reversals. By following a structured approach to identifying the pattern, managing risk effectively, and confirming with volume and other indicators, you can enhance your trading strategy and increase your chances of success. Always practice sound risk management and adapt your strategy based on prevailing market conditions. Happy trading!

Disclaimer: This article is for educational purposes only and should not be considered financial advice. Read our full disclaimer.